The economics of 5G mmWave need to be considered:

The Deployment costs & Economics of 5G mmWave are considered in a range of scenarios where the short range and high throughput and capacity of mmWave could lead to targeted deployments, and conditions under which these deployments could be cost effective. Three scenarios are modelled in detail:

1. mmWave to provide additional capacity in dense urban areas

2. Providing home broadband through FWA

3. Indoor solutions that can accommodate high traffic demand in an office space.

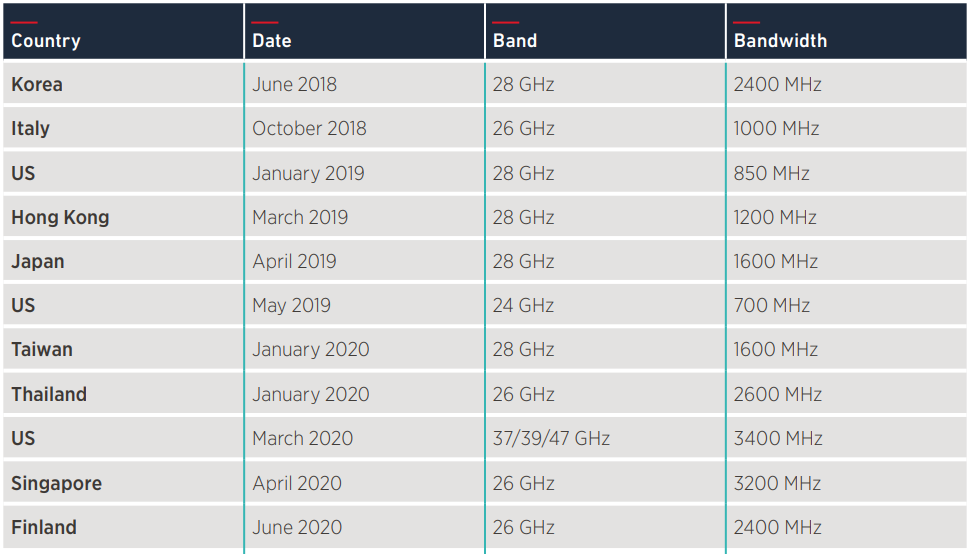

While commercial mmWave 5G networks have already been successfully launched in some countries, mmWave 5G solutions need to achieve more scale to reduce deployment costs, increase the choice of affordable devices available and facilitate greater adoption. The scale that any technology solution reaches is critical to determining its success and adoption. The momentum for mmWave is building across the three areas that are needed for any 5G band to gain the necessary scale and adoption: spectrum availability, a sufficient choice of consumer devices, and reliable and cost-effective network equipment. This should help inform mobile operators’ considerations of the role that mmWave will play a role in their deployments and when to initiate or accelerate investments in the technology.

USA:

mmWave spectrum assignments in the US

China:

Is gearing up for mmWave, with deployments firmly planned for the 2022 Winter Olympics

Europe:

Not many mmWave assignments yet, but momentum is building

In other regions, mmWave spectrum licensing conditions are diverse

5G mmWave CPE devices:

mmWave 5G consumer devices are becoming more widely available.

Some scepticism surrounded the potential use of mmWave in mobile telecommunications until very recently. A number of mobile network operators successfully carried out field trials on mmWave services at the beginning of 2017 and vendors and OEMs started to develop 5G CPEs and network equipment. In October 2018, a leading operator in the US launched a commercial pre-5G FWA internet service in a few cities.

The growth in the number of available mmWave handsets and CPEs in these last few years has been remarkable. A few mmWave handsets and FWA CPEs were launched in 2019, and we expect that more than 30 handsets and 35 CPEs will be available by the end

of 2020.

Consumers can expect more than 100 mmWave handsets and more than 50 FWA CPEs to be available in the market in 2021. With scale comes lower prices for devices. In

general, 5G device costs have already started to fall as scale economies are realised and the range of vendors supplying 5G devices grows. The use of global standardised variants of key smartphone components brings major benefits, as the increased scale in production and the need for fewer design teams outweigh certain higher upfront costs, such as

the need to support multiple spectrum bands. The US market in particular is currently at the forefront in the availability of mmWave devices – with the new mmWave-capable iPhone 12 series a good example of that – giving an additional boost for wider adoption of

the technology.

5G mmWave Base Stations

mmWave equipment categories fall into the following:

- High-capacity macro site active antenna units (AAUs): These active antenna units can provide enough capacity in densely populated areas for a large number of subscribers and are focused on spectrum between 24.25 and 29.5 GHz.

- Microsites, lamp sites and pole sites: Most of these serve the 26 GHz or the 28 GHz spectrum in a 2T2R 800 MHz or a 4T4R 400 MHz set-up. These compact and energy-efficient small cells help to provide coverage in outdoor hotspots.

- Indoor 5G small cell solutions: Vendors started to release indoor 5G small cells using mmWave to make sure operators can provide continuous 5G mmWave coverage. These small cells can ensure fibre-like speed in the mmWave spectrum with compact, lightweight equipment. Leveraging existing Ethernet cabling, and weighing less than 4 kg, they can generally be easily installed by one engineer

Fixed wireless access scenarios

Deploying a 5G FWA network using mmWave spectrum can be cost effective. The results

are sensitive to overall traffic demand, mmWave propagation performance and the share of downlink and uplink in total traffic at the peak demand hour. In a rural US town, suburban Europe and urban China, mmWave FWA can be a cost-effective strategy if 5G FWA is able to capture a good percentage of the residential broadband market demand, traffic demand during the busy hour is relatively high and data consumption does not slow down.

Indoor scenario for 5G mmWave

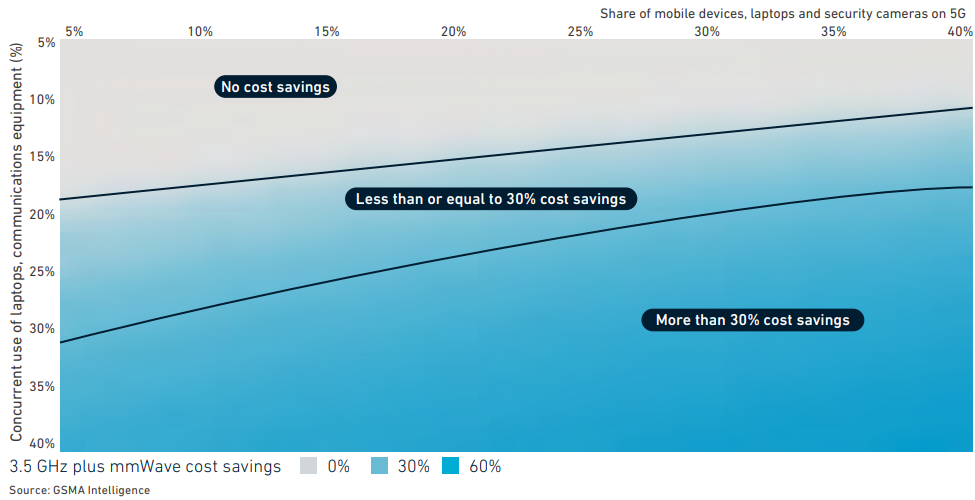

Consider the cost effectiveness of deploying mmWave indoor small cells along with mid-band small cells in a hypothetical office building

When a significant share of data traffic from devices needs to be supported by indoor 5G

services, a mmWave network could generate cost savings of up to 54%. The precise value in the range depends on the share of devices concurrently active and on whether and to what extent there is the need to provide connectivity to next-generation video

communications equipment.

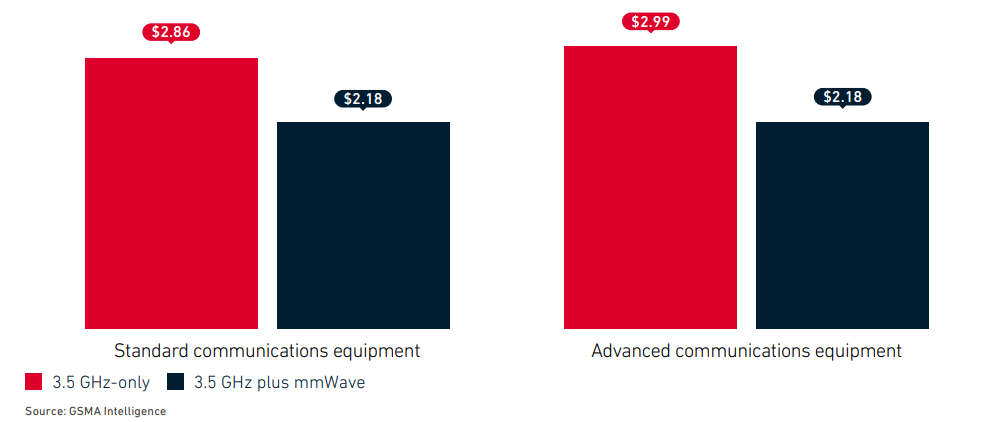

Depending on whether standard or advanced communications equipment is deployed,20 mmWave indoor small cells alongside 3.5 GHz small cells could provide cost savings between 42% and 46%. In the case where standard communications equipment is

deployed, the deployment of mmWave small cells to complement a 3.5 GHz network is cost effective when the share of mobile devices, laptops and security cameras exceeds 10% and the share of laptops and standard communications equipment is above 17%.

Cost savings in an indoor office space scenario – standard communications

equipment

Cost per square metre in an indoor office space scenario:

Conclusions

TCO analysis shows, despite its shorter range and higher equipment costs, the high throughput and capacity of mmWave could lead to targeted cost-effective 5G deployments. These have clear implications for mobile operators, device and equipment manufacturers, and governments:

- Mobile operators should not underestimate the role of mmWave in the short term

- Governments and regulators should facilitate the timely availability of mmWave

spectrum bands, in the right conditions - Market readiness has been achieved and a greater choice of equipment and devices

is expected to accelerate adoption

Various content reproduced courtesy GSMA Intelligence

For Further Information

Please Contact Us